elofic industries limited unlisted shares

Enquiry

About Elofic Industries Limited Unlisted Shares

(i) Elofic Industries Limited was incorporated in 1973, under the provisions of the Companies Act, 1956. The company along with its subsidiary (collectively referred to as the Group) is engaged in manufacturing and supplying of automobile filters and lubes. The Holding Company has its Registered Office at 14/4, Mathura Road, Faridabad-121003. Elofic

(ii) Elofic is one of India's largest filter manufacturing companies producing a complete range of filters and lubricants. With a legacy spanning over 67 years, a workforce of more than 600 professionals across six state-of-the-art manufacturing facilities in Faridabad (Haryana), Nalagarh (Himachal Pradesh), and Hosur (Tamil Nadu) in India and a global clientele consisting of Fortune 1000 blue-chip corporations, Elofic is a brand that inspires trust. Elofic offers the following filtration and lubrication products: oil filters, air filters, fuel filters, hydraulic filters, coolants and lubricants, and grease.

(iii) Products Catalogue

(iv) Elofic is the trusted name among Indian and Global automobile players. Few prominent names are mentioned in the below table.

| Domestic | International |

| Action Construction Equipment Ltd. | Argo Tractors, Italy |

| Bosch Limited. | Briggs & Stratton, USA |

| Escorts Construction Equipment Ltd. | Generac Power Systems Inc, USA |

| Godrej & Boyce Mfg. Co. Ltd | Kawasaki Motors Manufacturing Corpn., USA |

| JCB India Ltd. | Kohler Engines, USA |

| International Tractors Limited | Wabco, Germany |

| Mahindra & Mahindra | Lombardini, Italy |

| Maruti Suzuki India Limited | |

| Renault Nissan Mitsubishi Alliance, India | |

| VST Tillers & Tractors Ltd. | |

| Volvo Eicher Commercial Vehicles Ltd. | |

| TATA Motors |

(v) Subsidiary

The company has one subsidiary in the USA with the name Elofic USA, LLC. The company has 100% stakes in the subsidiary.

Corporate Video of Elofic Industries

Now, Check Elofic Share Price at Unlistedzone APP

Frequently Asked Questions

Ques. Is it legal to buy Elofic Industries shares in India?

Ans. Yes, it is 100% legal to buy Elofic Industries shares in India.

Ques. How to buy Elofic Industries unlisted shares?

Ans. You can buy Elofic Industries unlisted shares with India's most trusted platform UnlistedZone

Ques. What is the business of ELOFIC INDUSTRIES LIMITED?

Ans. Elofic Industries is engaged in manufacturing and supplying of automobile filters and lubes.

Ques. What is the incorporation date of ELOFIC INDUSTRIES LIMITED.?

Ans. Elofic Industries Limited was incorporated in 1973.

Ques. How to check Elofic share price?

Ans. You can easily check Elofic Share Price on UnlistedZone website and UnlistedZone App

| Price Per Equity Share | ₹ 2950 |

| Lot Size | 25 Shares |

| 52 Week High | ₹ 3000 |

| 52 Week Low | ₹ 2150 |

| Depository | NSDL |

| PAN Number | AAACE0425C |

| ISIN Number | INE02YY01015 |

| CIN | U74999HR1973PLC070262 |

| RTA | Alankit Assignments Limited |

| Market Cap (in cr.) | ₹ 738 |

| P/E Ratio | 15.36 |

| P/B Ratio | 2.77 |

| Debt to Equity | 0 |

| ROE (%) | 18.71 |

| Book Value | 1066 |

| Face Value | 10 |

| Total Shares | 2500000 |

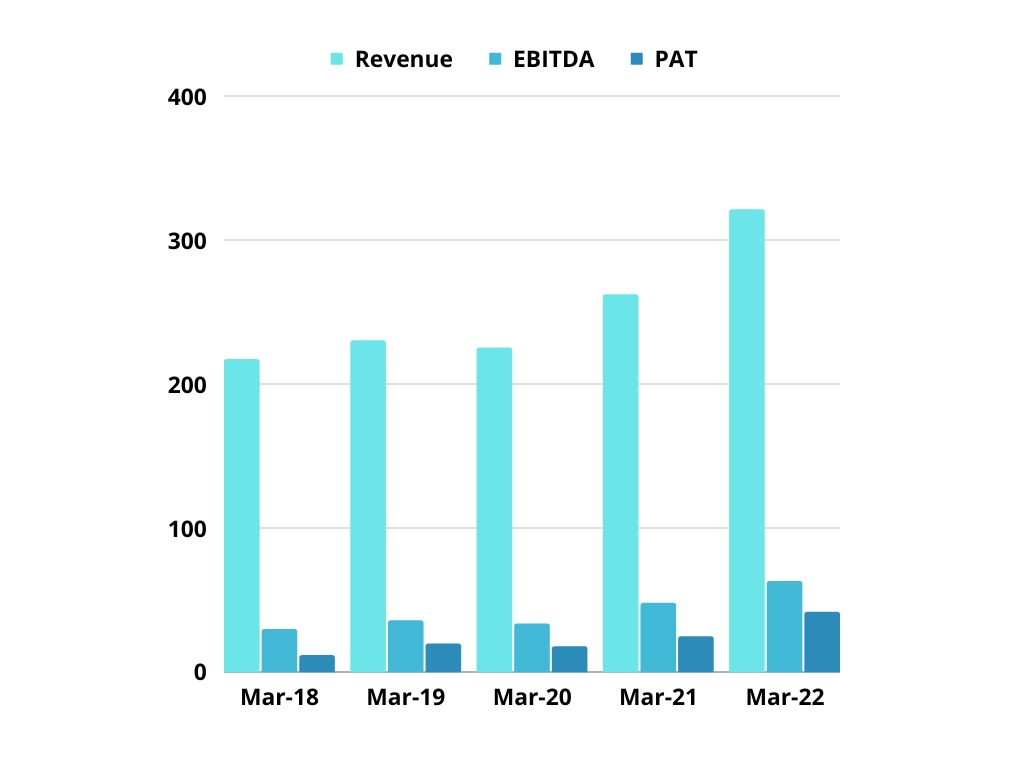

Financials

| P&L Statement | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Revenue | 261 | 330 | 359 | 352 |

| Cost of Material Consumed | 124 | 155 | 171 | 161 |

| Gross Margins | 52.49 | 53.03 | 52.37 | 54.26 |

| Change in Inventory | -3 | -3 | -3 | -1 |

| Employee Benefit Expenses | 38 | 42 | 47 | 51 |

| Other Expenses | 55 | 70 | 75 | 69 |

| EBITDA | 47 | 66 | 69 | 72 |

| OPM | 18.01 | 20 | 19.22 | 20.45 |

| Other Income | 1 | 1.6 | 2.01 | 7 |

| Finance Cost | 1 | 0 | 0.3 | 0.2 |

| D&A | 9 | 9 | 9.7 | 12 |

| EBIT | 38 | 57 | 59.3 | 60 |

| EBIT Margins | 14.56 | 17.27 | 16.52 | 17.05 |

| PBT | 38 | 56 | 53.75 | 67 |

| PBT Margins | 14.56 | 16.97 | 14.97 | 19.03 |

| Tax | 13 | 17 | 16.18 | 19 |

| PAT | 25 | 39 | 37.57 | 48 |

| NPM | 9.58 | 11.82 | 10.47 | 13.64 |

| EPS | 100 | 156 | 150.28 | 192 |

| Financial Ratios | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Operating Profit Margin | 18.01 | 20 | 19.22 | 20.45 |

| Net Profit Margin | 9.58 | 11.82 | 10.47 | 13.64 |

| Earning Per Share (Diluted) | 100 | 156 | 150.28 | 192 |